Power Of Attorney Format In Word For Income Tax

Revocation of prior powers of attorney.

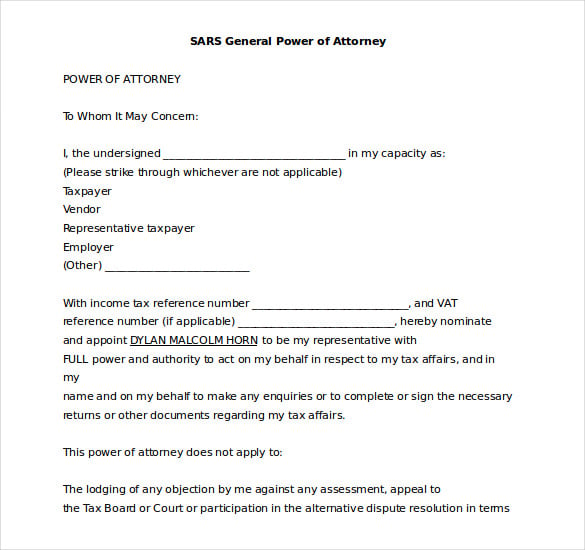

Power of attorney format in word for income tax. Form poa 1 power of attorney. This power of attorney on behalf of the taxpayer. You may authorize a student who works in a qualified low income taxpayer clinic litc or student tax clinic program stcp to represent you under a special appearance authorization issued by the taxpayer advocate service. Use form 2848 to authorize an individual to represent you before the irs.

2015 allows an individual or business entity to elect a party usually an accountant or tax attorney to file federal taxes on their behalf. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Irs power of attorney form 2848 revised in dec. Specific tax filing periods.

A power of attorney poa is a legal document authorizing someone to represent you. Type of maryland tax income employment maryland tax form number 502 mw506 year s or period s covered. We m s jagdish chand co j c gupta praveen kumar jain pankaj aggarwal chartered accountants do hereby declare that being accountants we are duly qualified under section 288 of income tax act 1961 xliii of 1961 to attend on behalf of the above mentioned assessee. An individual not a firm or business to act on your the executor s or administrator s behalf for an estate tax matter.

If the power of attorney form does not include all the information as instructed it will not be accepted. The tax matters to be discussed by the taxpayer s representative with power of attorney must include the following information. Form et 14 estate tax power of attorney. This form is issued by the tax departments of the various states and is subject to some unique rules and regulations.

You the taxpayer grantor must complete sign and return this form if you want to grant power of attorney to an accountant tax return preparer attorney family member or anyone else to act on your behalf with the idaho state tax commission. Specific tax matters such as a release of lien. The individual you authorize must be a person eligible to practice before the irs. Further you can also file tds returns generate form 16 use our tax calculator software claim hra check refund status and generate rent receipts for income tax filing.

A state tax power of attorney form is a legal document that is used by one party to confer to another party the power to file tax returns and manage one s finances.